Irs Useful Life Of Solar Panels

Photovoltaic pv modules typically come with 20 year warranties that guarantee that the panels will produce at least 80 of the rated power after 20 years of use.

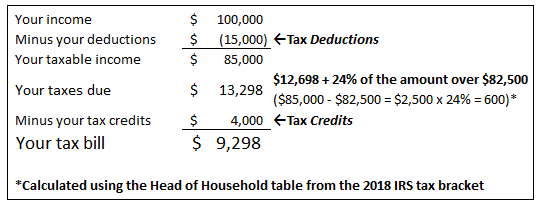

Irs useful life of solar panels. The useful life of computer software leased under a lease agreement entered into after march 12 2004 to a tax exempt organization governmental unit or foreign person or entity other than a partnership cannot be less than 125 of the lease term. The term solar energy property includes equipment and. See line 12c later. 13081f how to depreciate property section 179 deduction special depreciation allowance macrs listed property for use in preparing 2019 returns get forms and other information faster and easier at.

For the reasons set forth in this letter ruling request you request that the internal revenue service rule on the following issues. 1 whether the battery will be considered a qualified solar electric property. That means at least 25 years of free electricity. The credit for solar illumination and solar energy property is reduced from 30 to 26 for property the construction of which begins after december 31 2019.

A recent tax court case illustrated several issues common to trades or business but in the unusual context of a taxpayer who purchased solar powered electricity generating equipment installed on a third party host property. Estimated useful life when placed in service of at least three years and constructed after certain dates. Qualifying solar energy equipment is eligible for a cost recovery period of five years. The general rule of thumb is that panels will degrade by about 1 each year.

Internal revenue service publication 946 cat. It looks like solar panels have a 5 year life. Sections 1 48 9 d 1 of the regulations provides in part that energy property includes solar energy property. Remaining useful life of the solar energy system.

The irs found taxpayers donald and sheila golan responsible for a tax deficiency of 150 694 and an accuracy related penalty of 30 139 after examining their 2011 income. With accelerated depreciation the 26 solar tax credit srecs and grants some commercial solar systems reach payback in as little as five years. For equipment on which an investment tax credit itc grant is claimed the owner must reduce the project s depreciable basis by one half the value of the 30 itc.